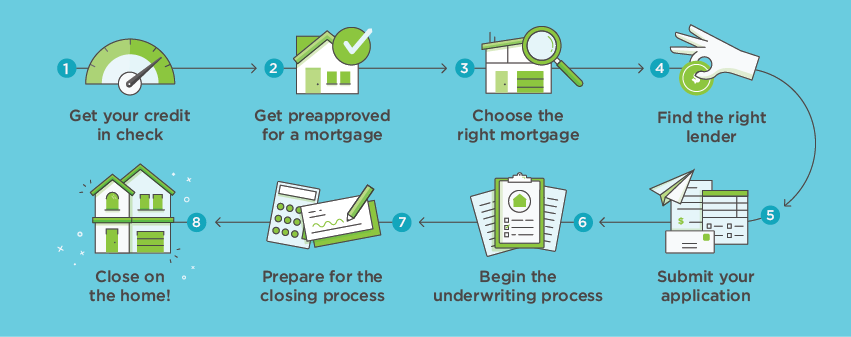

From preapproval to closing, here's a guide for navigating the mortgage landscape.

For most homebuyers, a mortgage is essential — but the process of obtaining one can be a little intimidating.

There's an old saying: battles are won before the fight, through preparation. In that spirit, here's a step-by-step guide to the process of obtaining a mortgage.

1) Find a Lender

Your homebuying quest shouldn't start with looking for a house — it should start with finding a lender. Mortgages are long-term relationships, and you'll want to be confident that your mortgage provider offers a strong combination of quality service and competitive pricing.

Also, consider the reputation and strength of the company. It doesn't always pay to go with the lowest rates — closing costs and fees can contribute to a higher overall cost of the loan.

2) Get Preapproved

Most real estate agents need you to get preapproved for a mortgage before they'll take you to look at homes. Doing so will help you save time later in the process and, even more importantly, be in a stronger position to make a credible offer to a seller.

A preapproval is a preliminary indication of how large a mortgage you qualify for. The lender will do a quick evaluation of your ability to afford a mortgage payment, based on your credit score, income and debts.

If you are preapproved, you'll get a preapproval letter to help with your home search. The process may also help identify any potential problems with your credit.

3) Make an Offer

Once you've found an affordable property you like, make an offer. Be sure to put the seller's asking price into context by researching the selling prices of comparable homes in the area.

If the offer is accepted, you'll create something called a purchase contract, which formalizes both parties' intention to go through with the deal. Send a copy to your lender.

4) Finalize the Loan

If the seller accepts your offer, it's time to finalize your mortgage application.

The lender will formally evaluate you through a process called underwriting. The goal is to assess your ability to pay back the money that you borrow. Doing so requires a check of your credit score, income, assets, and past and current debts.

To keep things moving, be ready to quickly respond to any requests for additional documents or details.

5) Close on Your Home

Closing is the last stage in both the mortgage and homebuying processes. It's a meeting of the buyer, seller and other professionals involved in the transaction. At closing, you'll sign dozens of documents. Some are specifically associated with the mortgage